I Get It: Why You’re Ignoring Finance

Many young people tend not to be interested in the concepts related to financial independence. Things like: investing strategies, tax optimization, expense reduction, etc. I can say this with certainty because I was a young person once. Life is full of wonders, experiences, luxuries, friendships, and pleasures both in the present and those to be acquired. Particularly after completing a college education and acquiring gainful employment, this feels like the time to enjoy life and the fruits of your labor, NOT like the time to spend pouring over budgets, tax brackets, expense ratios, rates of return, and all the other practical subjects that the education system failed to teach us. Plus, that stuff is boring, and you have a fat paycheck coming in now!

I get it.

But, time is the #1 resource at your disposal. Small delays in implementing simple FI concepts can add years, even decades, to your financial independence timeline. And it’s a shame, because these are really BASIC concepts and require minimal effort to set up on 95%+ auto-pilot. It’s like running a marathon, and right when you’re about to win, slowing to a walk 10 yards from the finish line.

The 3 Steps: Your ASAP Action Plan

For newly employed young people (or any age, for that matter), the simplest and most effective thing you can do right now for your financial future is:

- Enroll and set up automatic contributions in your employer’s retirement plan

- Contribute the maximum allowed amount

- Designate these contributions 100% into a single low expense total US stock market index fund.

That’s it. You could take no further action for the next 10, 20 or even 30 years and wind up financially independent with a fully-funded retirement. Let me make two very important notes about what I’ve said here. First, there’s MUCH more you can do to accelerate your FI journey than just these things, but they mostly come back to enabling you to do more of these things (i.e .investing). Second, this is blanket advice for most people with 10+ years until retirement.

We’ll briefly cover some additional info in this post. But, look for more detail in later blog posts here or in the abundance of information already available in the FIRE community.

Enroll and Set Up Automatic Retirement Plan Contributions

Anyone, but especially people with newly found wealth like young college grads entering the workforce, are set up for financial failure in a number of ways. First, you likely don’t have experience managing money yet, so you’re naturally going to be bad at it when it starts flowing into your pocket. Second, we are bombarded 24×7 with ads to buy, buy, and buy crafted by experts on human psychology. These experts are well-versed on the mental & emotional triggers that push us to consume goods & services. We hardly stand a chance resisting them. Third, humans are hard-wired to compare themselves to other humans. And the old saying “comparison is the thief of joy” couldn’t be more true. You’re going to see people that “appear” to be living a better life with oversized houses, luxury autos, vacations, expensive dining, fashionable clothes and a host of tech gadgets. They’ll post all this stuff on social media to portray how wonderful their lives are. But, what social media doesn’t show is that these people often have little savings and are fully leveraged with debt. It’s going to be difficult to not be swayed into increasing your lifestyle to match theirs.

That’s the beauty of setting up automatic retirement plan contributions with your employer – they come out of your paycheck BEFORE you ever see it. You don’t have a chance to spend it. Think about it: if you’re coming from no/low income and you land a job making $70k, you’d make it on that and probably be pretty darn happy. But, what if you landed a job making $90k? You’d likely live on that and be pretty happy also. But we’ve already established you can be happy spending a $70k salary. So, why not have that extra $20k automatically invested for you and live off the other $70k? I promise you, it’s WAY easier to limit your lifestyle adjustment up to $70k than it is to try and adjust down from $90k to $70k later.

Contribute the Maximum Allowed Amount

There are times this may not be feasible, and I get that. But you should strive to contribute the maximum allowed amount each year. These plan contributions have huge tax advantages each year. Since these advantages have a “per year” limit and do not carry forward, you never get these tax advantages back. At the VERY MINIMUM, you should invest at least enough to capture any matching contributions that your employee offers. For example, if your employer will match 60% up to 3% of your salary, then the very minimum you should contribute is 3% of your salary. Any less is throwing away free money.

Invest in a Single Low Cost Total Market Index Fund

This topic deserves a blog post all its own, and I’ll do one eventually. Meanwhile, there’s an abundance of information available on this topic in the FIRE community. But for now, just know that if you’re 10 or more years from retirement all you need to do is invest in this single fund.

Pick a US total market index fund with the lowest expense ratio from your employer’s plan, direct 100% of your contributions to that, and never look at it again for the next 10+ years (unless you want to). I can’t think of a simpler strategy and in almost all cases it’s more effective than trying to do more complicated investing.

The Time Tax / The Cost of Delay

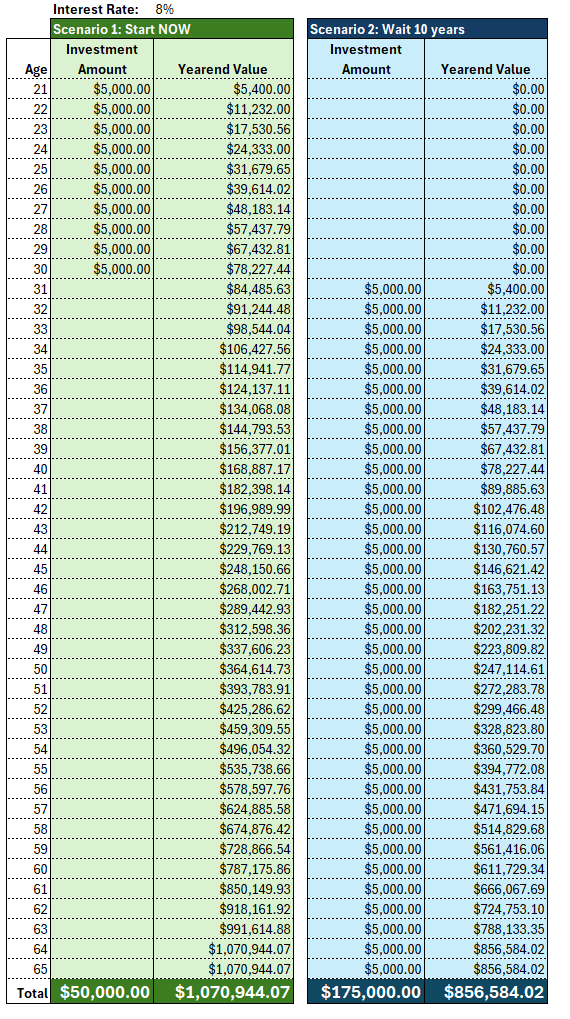

Why do you need to act ASAP? This is another topic that deserves its own blog post; look for that here soon. The short answer is: compounding is THE magic sauce in the financial independence journey and compounding needs time to work. The sooner you act, the more time compounding has to work for you. Compounding is simple: it’s the snowball effect you get from earnings that accumulate not only on your initial investments but also on previous earnings. The concept is simple. Let’s say you can earn 10% on your initial investment of $1,000. The first year, you earn $100 (10% of $1,000). But since you understand the value of compounding, you leave that new $100 invested and you now have $1,100 to begin year 2. In year 2, you earn $110 (10% of $1,000). And note that you did this with 0 effort on your part. Year 3, you start with $1,210 ($1,000 + $100 + $110) and your earnings jump to $121. You get the idea, simple, right? Despite the simplicity, the human mind can barely comprehend the power of compounding over larger amounts of time. Take a look at the simple chart below illustrating the power of compounding. I used a more conservative interest rate of 8% here. Scenario 1 person invests $5,000/year for the first 10 years, then never invests another penny. Scenario 2 person, waits 10 years then invests $5,000/year for the next 35 years. Despite investing less than a third of scenario 2, scenario 1 ends up with over $200,000 more! This is why it’s crucial to start now.

6 Psychological Traps Keeping You Broke (and How to Face Them)

Great question; glad you asked. Every person will be different, but it’s likely any 1 or more of the following reasons.

- The school system failed to teach us these things. We don’t even know what a retirement plan is, let alone that we should enroll in it. See blog post 003 | Nineteen Years of School, Zero Financial Clue.

- We’re instinctively hesitant to act on things we don’t understand. The unknown seems scary and overwhelming, so we avoid it.

- People are very private when it comes to money & investing. We’re afraid to ask and people are reluctant to share.

- Pride keeps us from asking for help. Whether it’s being afraid of looking dumb or the comparison thing where we’re embarrassed to share that we’re not as far along as our peers.

- The news media and investment industry has us convinced that investing is complicated. We’re bombarded with articles and “advice” that successful investing requires extensive knowledge, strategy, timing, and in-depth research. None of this is true. The truth is, the simpler your plan, the more likely you are to outperform the so-called “experts”.

- The stock market’s continual long-term rise is a rocky road of shorter-term ups & downs. This scares people and, in some cases, causes them to look at investing as “gambling”

Just putting a name to these reasons for inaction is a huge psychological step in helping us move forward. Naming things takes away their power over us. It shines a light on the previously scary darkness. We begin to see them for what they are: simple problems that can be addressed. But, let’s talk some specifics on each.

For reasons 1 & 2, I’ve given you the simplest, most impactful, single step to take immediately (more on the “immediately” part, later). Just get started here; you can gradually learn more at your own pace over the next 10+ years.

For items 3 & 4, this is where the FIRE community comes in. This community is rich with simple & sensible information (books, podcasts, articles) and with people that are glad to help.

Item 5 deserves an entire blog post. For now, suffice to say that both the news media and the investment industry stand to make huge profits from you and I. The news media makes massive ad revenue by getting you to click on their articles; learn to ignore them. The investment industry profits by selling you over-complicated investments and/or charging fees on assets they manage for you (usually a percentage of your total value). You don’t need either and having someone skimming 1-3% of your investments is devastating to your financial future.

Note: there are times to consult a financial professional. If and when you decide to do that, find one that works off an hourly rate instead of skimming a % of your assets. There are a number of such organizations that have sprung up in recent years as people have started to realize the huge negative impact of giving up an annual percentage of their assets.

Item 6 is the simplest to answer but possibly the hardest to follow. The simplest way is to pull up a graph of the S&P 500, Dow Jones Index, or similar and zoom all the way out. Below is the Dow Jones Industrial Average from Nov 1985 – Nov 2025. You can see the trend is always up although the road is often bumpy. You need to get comfortable thinking “big picture” so that you don’t panic and sell during the inevitable down swings.

Conclusion: Your One-Hour Path to Freedom

The entire setup — enrollment, maximizing contributions, and choosing a simple index fund — shouldn’t take you more than one hour. The greatest barrier to your financial freedom isn’t the stock market or your income; it’s procrastination.

If you haven’t started, grab a pen and paper. Ask yourself why not. Write down your specific reasons or fears. Think about each one rationally. Now, review the compounding chart one last time. Can you really afford to wait any longer and keep paying the Time Tax?

Get started now. Don’t wait. This is a “one and done” psychological win that will change your life.