The Power of a Number 🏋️

As mentioned in previous blog posts, we only learned about the FI community in the last few years. But we were unknowingly doing the FI basics for 25 years prior: living below our means, staying debt-free, and investing the surplus. I knew I should be able to retire comfortably someday, but I didn’t know how or when. And honestly, I loved my job and the company I worked for so I didn’t give actual retirement much thought.

That all changed in January 2023. Our small, family-like company of 45 employees was bought out by a private equity firm. We were combined with other “bought out” small companies into a conglomerate of 500+ employees. If you’re not familiar with private equity, the goal is simple: purchase multiple similar companies, combine them into a larger firm, and resell the larger firm for a profit. I don’t fault anyone here, but this was not the job I signed up for. In fact, it was everything I had left the corporate world to get away from 20 years earlier: corporate politics, employee handbooks, directives from people 3+ layers removed from the actual product, mandated training, endless meetings, non-compete contracts, and so on.

This pushed me to fast track my retirement efforts. I found the FI/FIRE community and started devouring podcasts, reading every book and article I could find, and seeking a way out of this new misery. By far, the most valuable concept I learned was the 4% rule, which is the simplest answer to the question “Can I retire?”. Using a single multiplication, the 4% rule gives you your Safe Withdrawal Rate (SWR) from your retirement savings. The answer the 4% rule gave me was “Yes, but it’s close”. After doing due diligence, examining our actual expenses and investments, that answer solidly became “Yes” and it gave me the freedom to exit a soul-crushing situation.

The History: From Rocket Science to Retirement Security 🚀

The 4% rule is the brainchild of Bill Bengen. Bill started with a B.S. from MIT in Aeronautics and Astronautics. He co-authored the book “Advanced Model Rocketry” from MIT Press. After working with his family-owned soft-drink-bottling franchise for 17 years, he moved to California and started a Certified Financial Planner practice, Bengen Financial Services and ran it as a fee-only practice for 20 years until he retired in 2013.

In 1994, Bengen set out to determine the maximum Safe Withdrawal Rate (with annual adjustments for inflation) from a 50% equities / 50% bonds portfolio that would guarantee the portfolio lasted 30 years. Bengen ran simulations over every historical 30-year period, starting from 1926. He looked for the highest withdrawal rate that survived even the worst economic periods (like the Great Depression). He found that 4% was the highest sustainable starting withdrawal rate for the worst-case scenario. (Most starting years supported a much higher withdrawal rate.)

While Bengen authored the original work, his findings were later confirmed and expanded upon by the famous Trinity Study in 1998, solidifying the 4% figure as the gold standard. Bengen’s 4% rule has continued to hold true through present times and is typically the starting foundation for retirement feasibility discussions in the FI/FIRE community.

NOTE: retiring early (i.e. the “RE” of “FIRE”) likely necessitates planning for more than the 30 years assumed by the 4% rule. Keep this in mind if you’re thinking of a longer retirement.

The 4% Rule in Practice: The SWR and Inflation 💲

Bengen’s 4% rule states simply that you can safely withdraw from your portfolio 4% the first year, then adjust that amount annually for inflation, for 30-years w/o fear of running out of money (based on historical data).

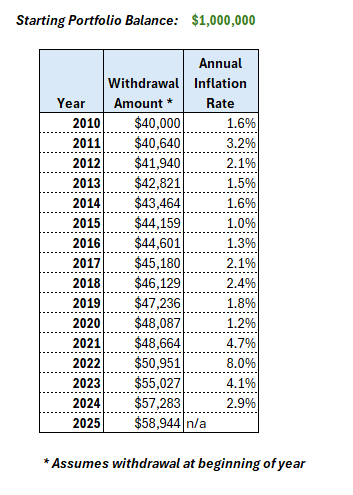

A simple illustration will clarify. In the chart below, we start retirement in 2010 with $1,000,000. We’ll assume we withdraw on January 1st each year.

First Year Calculation

We calculate our first withdrawal as 4% of our retirement portfolio balance.

Portfolio Balance * 0.04 = First Year Withdrawal Amount

In our example, that’s $1,000,000 * 0.04 = $40,000 for 2010.

Subsequent Years Calculation

Calculating the subsequent years is done by inflation adjusting the previous year’s withdrawal amount. This is to make up for the erosion of purchasing power done by inflation. So to calculate our 2011 withdrawal amount, we take 2010’s amount and adjust it for the inflation that occurred in 2010.

First, calculate the inflation adjustment.

Previous Year Withdrawal Amount * Previous Year Inflation Rate = Inflation Adjustment

For the second year (2011) in our example with 1.6% previous year inflation, that’s $40,000 * 0.016 = $640

Next, add that to the Previous Year Withdrawal Amount.

Previous Year Withdrawal Amount + Inflation Adjustment = Current Year Withdrawal Amount

In our example, our 2011 withdrawal amount is $40,000 + $640 = $40,640

Pro Tip: The shortened single calculation is:

Previous Year Withdrawal Amount * (1 + Previous Year Inflation Rate)

For 2011 that’s: $40,000 * 1.016 = $40,640

The inflation adjustment is a built-in to Bengen’s research and is a critical part of the 4% rule. It ensures your quality of life isn’t steadily eroded by inflation. But the real freedom-granting power of the 4% rule is its simple answer to the following question: “How much do I need to retire?”. Or more simply put in my case: “Can I Retire?”

Conclusion: When Can I Retire? 📆

The real freedom-granting power of the 4% rule is its simple answer to the question “How much do I need to retire?”

When I was in a soul crushing job, I had no idea if I could safely leave it or not. The 4% rule gave me the answer in 15 seconds. You just need two pieces of information: your current retirement portfolio balance and your estimated annual retirement expenses. There are two ways to calculate.

Method 1: The Maximum Withdrawal Calculator (The 4% Rule)

This calculation determines the maximum dollar amount you can safely take out annually.

Portfolio Balance * 0.04 = Maximum Annual Withdrawal Rate

- Example: You have a Portfolio Balance of $2,000,000.

- $2,000,000 x 0.04 = $80,000

- Conclusion: If your annual expenses are $80,000 or less, you can retire.

Method 2: The FIRE Number Calculator (The 25x Rule)

The inverse of 4% is 25. This easier calculation uses your spending to determine your minimum required savings goal (your FIRE Number).

Annual Expenses x 25 = Minimum Required Portfolio Balance

- Example: You want to live on $75,000 per year in retirement.

- $75,000 x 25 = $1,875,000.

- Conclusion: Your portfolio must be $1,875,000 or more in order to achieve your goal.

Summary: Important Caveats

Both calculations are valuable — one tells you your maximum Safe Withdrawal Rate, the other tells you your savings goal. Before relying on these numbers, it’s important to remember the following about the 4% rule:

- Time Horizon: Assumes a 30-year retirement. Longer periods may require additional savings.

- Asset Allocation: The original study assumed a 50% stock / 50% bond portfolio. Many people prefer a more aggressive mix (like 75 / 25 or 80 / 20), which has historically performed well over long periods but carries higher short-term volatility.

- Annual Retirement Expenses: Determining this can be tricky. Make sure to account for:

- Healthcare (insurance & expenses)

- Income taxes (especially if your portfolio is in pre-tax accounts like a 401k)

- Travel & vacation (you want to enjoy your freedom, right?)

- Unexpected / irregular expenses (home repair, automobile replacement, etc.)

For me, this simple calculation gave me the peace of mind to enter early retirement. At this writing, I’m 5 weeks into my early retirement. While I’m still adjusting, I can tell you it is AMAZING. I do what I want, when I want, how I want. Every. Single. Day. 🙂